Year-End Budget Flushes Yield Another Big Beat

NetScout’s (NTCT) fiscal Q3 ’26 results topped our estimates and consensus as customer budget flushes fueled a pull-forward in orders originally anticipated during the current quarter. Both the enterprise and service provider verticals contributed to the outperformance with one international channel partner comprising 10% of revenue in Q3 and another service provider customer also reaching that threshold. Demand was strong for both service assurance and cybersecurity solutions, particularly amongst enterprise customers, which accounted for several seven-figure deals in the quarter. As operating expenses also remained well controlled, the revenue upside largely flowed through to earnings and drove a significant beat relative to our estimates and consensus.

Considering the early closure of several large orders, management raised the low-end of its prior FY ’26 guidance ranges. Although the implied outlook for Q4 reflects a broad range of outcomes, management’s commentary during the earnings call suggests the midpoints of its respective guidance ranges are the likely scenario. In effect, this suggests NetScout should ultimately post FY ’26 results at or above consensus expectations heading into the print. Worth noting, management characterized the pipeline as robust and demand as strong but cited potential supply chain challenges, specifically its customers ability to procure the hardware necessary to run NetScout’s software, as one factor that could shift the timing of orders moving forward. While we do not believe this has impacted sales cycles to date, we surmise the potential risk along with other lingering macro issues, precluded management from being more constructive with the outlook.

Our full year estimates notch higher across our forecast horizon driven by a slight uptick in our expectations for service revenue. Our price target also increases from $43.00 to $46.00 based on a FY ’27 EV/EBITDA multiple of 12x. We note that our prior target was derived by applying that same multiple to our FY ’26 projections. Despite the substantial outperformance in Q3, shares of NTCT sold-off as the market seems to be myopically focused on guidance for the current quarter. We therefore continue to believe the stock is significantly undervalued. In our view, it is only a matter of time before investors recognize that the company is well positioned to benefit from investments in 5G and edge computing and generates significant cash flow to boot. With cash now comprising nearly 30% of the market cap, no debt on the balance sheet and significant free cash flow generation, we further posit that the company could manufacture a catalyst of its own (or be prodded to do so by an activist) by levering up to repurchase a more meaningful amount of stock.

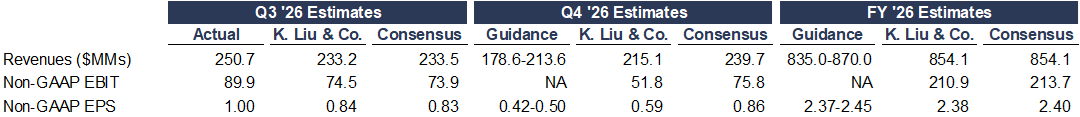

Exhibit I: Quarterly Results and Guidance Versus Expectations

Sources: NetScout Systems; K. Liu & Company LLC; FactSet Estimates

Q3 revenue of $250.7 million (-0.5% Y/Y) was well above our estimate of $233.2 million and consensus of $233.5 million due to strong calendar year-end spending by enterprise and service provider customers alike. We note that this dynamic was also present in the year-ago quarter, creating a difficult comparison from a growth standpoint. Both product sales of $121.7 million (-5.0% Y/Y) and service revenue of $129.0 million (+4.1% Y/Y) benefited from the timing of orders and exceeded our estimates. By product, revenue from service assurance solutions comprised 63% of revenue and declined 3% Y/Y, while cybersecurity sales comprised the remaining 37% of sales and increased 4% Y/Y. By vertical, revenue from service providers comprised 45% of total revenue in Q3 and declined 6% Y/Y, while revenue from enterprise customers accounted for 55% of revenue and increased 4% Y/Y.

Non-GAAP gross margin of 82.8% was ahead of our 81.7% assumption due to higher service gross margin. Total operating expenses were marginally above our forecast, which was primarily attributable to higher sales and marketing expenses. With much of the revenue upside flowing through to the bottom line, both non-GAAP operating income of $89.9 million (35.9% margin) and adjusted EBITDA of $91.7 million (36.6% margin) beat our estimates of $74.5 million and $77.1 million, respectively. Non-GAAP EPS of $1.00 also handily beat our $0.84 estimate and the Street’s $0.83.

Cash and investments at quarter-end totaled $586.2 million. In Q3, NetScout generated $62.1 million in cash flow from operations and used $2.8 million for capital expenditures. The company did not repurchase any stock in the quarter but per management, intends to be active in the market for the remainder of this year and next, subject to market conditions.

With Q3 benefiting from the favorable timing of orders, management raised the low-end of its prior FY ’26 revenue and non-GAAP EPS guidance ranges. Commentary during the earnings call suggests that while the implied ranges for Q4 are broad, the midpoint of guidance is the likely outcome at this juncture. In this regard, the guidance revision leaves NetScout on track to meet or exceed both consensus and our prior expectations for FY ’26.

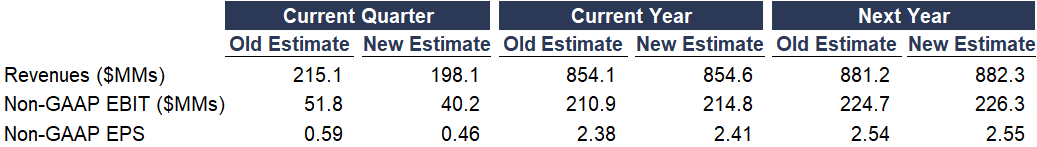

Exhibit II: Estimate Revisions

Source: K. Liu & Company LLC

Our estimates for FY ’26, FY ’27 and FY ’28 all notch higher, primarily reflecting a slight uptick in our expectations for service revenue. We continue to believe NetScout is at the start of a new growth cycle, which in turn should yield steady margin expansion over the next few years.

Our report with model and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has not received any compensation from NetScout Systems (NTCT) in the past 12 months.

The analyst, a member of the analyst’s household, and/or an account in which the analyst exercises discretion hold(s) a long position in the common stock of NetScout Systems (NTCT).