Cleared for Takeoff

DHI Group’s (DHX) Q4 ’25 results exceeded our estimates and consensus. Revenue from each of the company’s platforms outpaced our expectations, which combined with lower sales and marketing expenses, drove a significant beat on both the adjusted EBITDA and non-GAAP EPS lines. Beneath the covers, key metrics across both ClearanceJobs and Dice improved on a sequential basis and reflected further signs of stabilization versus the prior year period. We were especially encouraged by ClearanceJob’s rapid return to bookings growth following the ill effects of the government shutdown in Q3. We were also pleased to see Dice’s revenue renewal rate reach the highest level seen in all of FY ’25.

As for the new year, management’s FY ’26 guidance bracketed our estimates and consensus. That said, the underlying expectations for ClearanceJobs and Dice deviated slightly from our prior assumptions, reflecting higher growth for the former and a protracted return to growth for the latter. For ClearanceJobs, the recent signing of the Consolidated Appropriations Act of 2026 into law should provide a nice tailwind to bookings given the significant increase in funding for defense spending. For Dice, stabilizing demand for IT staffing portends continued moderation in the rate of decline but management remains cautious on the potential for renewed growth. Aside from some fine tuning, our estimates for this year and next remain largely intact. We think the outlook is prudent at this stage but ultimately believe that any adjustments over the course of the year are likely to be upwardly biased.

Although yesterday’s print and outlook produced no real surprises from our vantage point, shares of DHX reacted very positively in after-hours trading. We attribute the move to multiple factors: relief that the declines seen at ClearanceJobs during Q3 were indeed a blip, signs that the Dice business is near a bottom and an overly depressed valuation for a company with high recurring revenues and EBITDA margins. In any event, we believe there is far more upside to be had as DHI Group remains in the early innings of a new growth cycle underpinned by a worldwide ramp in defense spending and an ever-changing technology landscape. Our price target remains $4.50 based on an unchanged FY ’26 EV/Sales multiple of 2x.

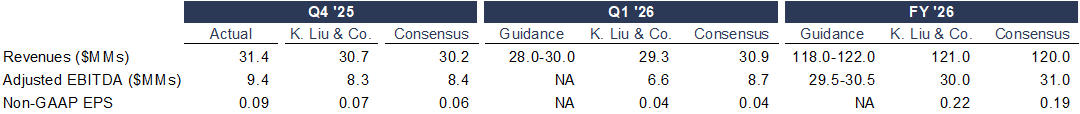

Exhibit I: Reported Results and Guidance Versus Expectations

Sources: DHI Group; K. Liu & Company LLC; FactSet Estimates

Q4 revenue of $31.4 million (-9.8% Y/Y) was above our $30.7 million estimate and consensus of $30.2 million. Both ClearanceJobs revenue of $13.9 million (+1.3% Y/Y) and Dice revenue of $17.4 million (-17.1% Y/Y) exceeded our estimates of $13.5 million and $17.2 million, respectively.

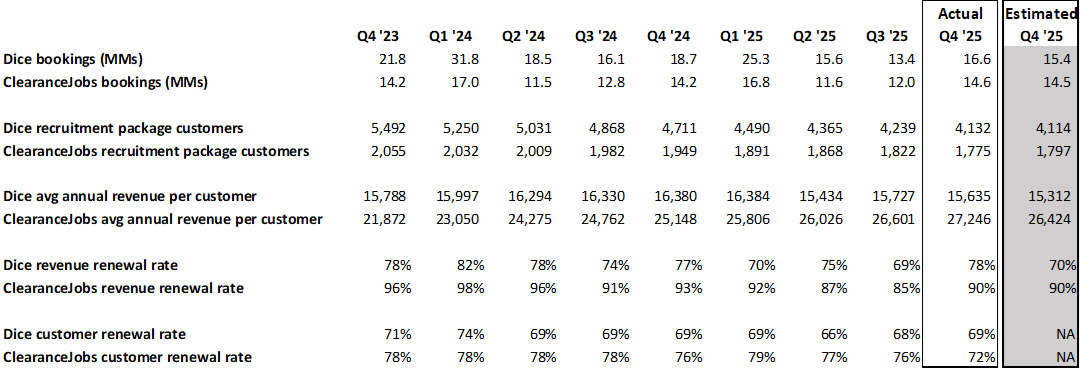

ClearanceJobs bookings of $14.6 million (+3.0% Y/Y) were consistent with our $14.5 million projection, while Dice bookings of $16.6 million (-11.4% Y/Y) declined by less than we feared. Importantly, revenue renewal rates across both platforms rebounded from the lows seen in Q3 and average annual revenue per customer continued to increase.

Exhibit II: Key Metrics

Sources: DHI Group; K. Liu & Company LLC

Gross margin of 85.5% was above our 84.5% assumption due to higher revenue and lower costs than we projected. Total operating expenses (excluding impairment and other non-recurring expenses not factored into our model) were also below our estimate, primarily due to lower sales and marketing expenses. As a result, adjusted EBITDA of $9.4 million (29.8% margin) beat our $8.3 million estimate and the Street’s $8.4 million. Non-GAAP EPS of $0.09 also beat our estimate of $0.07 and the Street’s $0.06.

In Q4, DHI Group generated $7.2 million in cash flow from operations and used $1.5 million for capital expenditures. Cash at quarter-end totaled $2.9 million, while outstanding debt remained unchanged at $30.0 million. During the quarter, the company repurchased approximately 2.9 million shares at a total cost of $5.2 million. With the prior authorization exhausted, the Board of Directors has approved a new $10 million stock repurchase program.

Management’s FY ‘26 guidance calls for revenue of $118.0-$122.0 million and an adjusted EBITDA margin of 25%, implying adjusted EBITDA of $29.5-$30.5 million. Prior to revisions, we were projecting revenue and adjusted EBITDA of $121.0 million and $30.0 million, respectively, while consensus stood at $120.0 million and $31.0 million. For Q1, management’s guidance calls for revenue of $28.0-$30.0 million, in line with our prior estimate of $29.3 but below the Street’s $30.9 million.

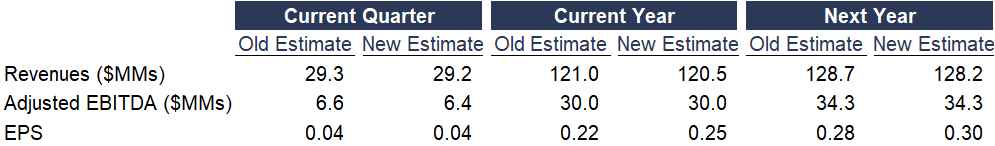

Exhibit III: Estimate Revisions

Source: K. Liu & Company LLC

On the surface, our estimates for this year and next are little changed. However, our projections now reflect higher growth at ClearanceJobs offset by a delay in renewed growth at Dice. Importantly, we expect ClearanceJobs to generate bookings growth in the mid-teens in FY ’26, which should set the stage for a return to double-digit revenue growth and margin expansion in FY ’27.

Our report with model and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has received compensation from DHI Group, Inc. (DHX) in the past 12 months for “Sponsored Research.”

Sponsored Research produced by the firm is paid for by the subject company in the form of an initial retainer and a recurring monthly fee. The analysis and recommendations in our Sponsored Research reports are derived from the same process and methodologies utilized in all of our research reports whether sponsored or not. The subject company does not review any aspect of our Sponsored Research reports prior to publication.