Q4 ’25 Earnings Preview

DHI Group (DHX) reports Q4 ’25 results on Wednesday, February 4, after the market closes. Both CompTIA’s analysis of tech hiring and the Bureau of Labor Statistics’ latest JOLTS data point to relatively stable labor market conditions over the remainder of FY ’25. Most notably, the magnitude of Y/Y declines in new job postings held steady from Q3 to Q4. Early reports from the likes of Manpower (MAN) and Robert Half (RHI) have also confirmed as much, reflecting moderating Y/Y declines in revenue and favorable sequential trends that have continued into the new year. While both have guided for a down year in revenue, the tide is expected to turn within the next few quarters assuming the pace of sequential improvement continues unabated. Commentary from both staffing services providers also suggests pent-up demand for technologists could be unleashed as previously delayed projects move forward. With this in mind, we expect DHI Group to report Q4 ’25 results consistent with Street expectations and believe management’s FY ’26 guidance will follow a script similar to the aforementioned staffing providers.

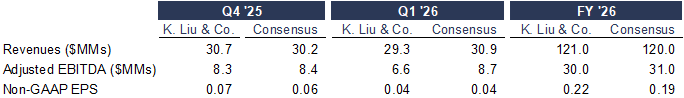

Exhibit I: Our Estimates Versus Consensus

Sources: K. Liu & Company LLC; FactSet Estimates

We project Q4 revenue and adjusted EBITDA of $30.7 million and $8.3 million, respectively, both of which are largely in line with consensus. Our estimates include Dice and ClearanceJobs revenue of $17.2 million and $13.5 million, respectively, along with bookings declines of 18% Y/Y at Dice and 2% Y/Y at ClearanceJobs. As for guidance, we remain comfortable with both our FY ’26 estimates and consensus, which assume full year declines in revenue and adjusted EBITDA but reflect improving sequential trends in both.

Given DHX’s depressed valuation, the prospect of renewed growth later this year should hopefully fuel a move similar to that seen for both MAN and RHI post-earnings. Regardless of how the upcoming print plays out, however, we believe market sentiment on DHX is poised to inflect positively given that the $1.0 trillion in U.S. defense spending earmarked for FY ‘26 is expected to be funded shortly, and the Trump administration has already proposed a 50% increase for FY ’27. These developments should be a boon for ClearanceJobs and ultimately accelerate top line growth across the company. Our price target remains $4.50 based on a FY ’26 EV/Sales multiple of 2x.

Our report with model and disclosures is available here.

Disclosure(s):

K. Liu & Company LLC (“the firm”) receives or intends to seek compensation from the companies covered in its research reports. The firm has received compensation from DHI Group, Inc. (DHX) in the past 12 months for “Sponsored Research.”

Sponsored Research produced by the firm is paid for by the subject company in the form of an initial retainer and a recurring monthly fee. The analysis and recommendations in our Sponsored Research reports are derived from the same process and methodologies utilized in all of our research reports whether sponsored or not. The subject company does not review any aspect of our Sponsored Research reports prior to publication.