Raises FY ’26 Guidance on Strong Q2 Performance

NetScout (NTCT) reported fiscal Q2 ’26 results well above our estimates and consensus. The strong performance was attributable to the acceleration of certain deal closures, including an eight-figure order from a government customer, originally expected to occur later in the year. We note that this is the first quarter we can recall when a customer outside of the service provider vertical comprised over 10% of revenue. That said, NetScout also saw solid growth from service providers, buoyed in part by the timing of large maintenance renewals. Although the pull-forward of orders provided a boost to Q2, we would be remiss if we failed to mention that product backlog exiting the quarter also increased sequentially despite the outsized revenue performance. Visibility therefore remains high heading into NetScout’s seasonally strongest period, which we find remarkable considering ongoing macroeconomic uncertainty and the U.S. government shutdown.

Stepping back, we believe NetScout’s return to revenue growth over the past twelve months marks the early innings of a new customer spending cycle. Competition among service providers continues to intensify, prompting accelerated investments in 5G capacity expansion, new service offerings such as fixed wireless access and other bundled solutions leveraging their infrastructure. As network usage grows, so too will spending on NetScout’s solutions. In a similar vein, the promise of AI has prompted a new wave of data center investments by enterprises and service providers alike. As AI adoption rises and traffic begins to flow, NetScout stands to benefit from both monitoring and securing the critical infrastructure.

Looking forward, management raised its FY ’26 guidance for both the top and bottom lines. For Q3, management’s expectations encompassed both our prior estimates and consensus. We raise our estimates slightly for this year and next, primarily reflecting an uptick in our product revenue projections and a corresponding bump in our gross margin assumptions. We also introduce our FY ’28 forecasts, which call for a continuation of the revenue growth and margin expansion trends depicted in our FY ’26 and FY ’27 estimates. With no material changes to our model, we maintain our $43.00 price target based on an unchanged FY ’26 EV/EBITDA multiple of 12x.

Exhibit I: Quarterly Results and Guidance Versus Expectations

Sources: NetScout Systems; K. Liu & Company LLC; FactSet Estimates

Q2 revenue of $219.0 million (+14.6% Y/Y) exceeded our estimate of $199.7 million and consensus of $200.3 million. Relative to our model, both product sales of $94.7 million (+16.9% Y/Y) and service revenue of $124.3 million (+12.9% Y/Y) surpassed our estimates. The former was driven by the timing of a large government deal closure, while the latter reflected the timing of a large maintenance renewal. By product, revenue from service assurance solutions comprised 66% of revenue and grew 18% Y/Y, while cybersecurity sales comprised the remaining 34% of sales and increased 8% Y/Y. By vertical, revenue from service providers comprised 39% of total revenue in Q2 and rose 25% Y/Y, while revenue from enterprise customers accounted for 61% of revenue and increased 9% Y/Y.

Non-GAAP gross margin of 81.4% was ahead of our 79.5% assumption due to better than expected product gross margin. Total operating expenses were above our forecast, largely due to higher commissions and incentive compensation accruals arising from the strong top line performance. Regardless, both non-GAAP operating income of $58.1 million (26.5% margin) and adjusted EBITDA of $60.7 million (27.7% margin) beat our estimates of $41.3 million and $44.0 million, respectively. Non-GAAP EPS of $0.62 also topped both our estimate and consensus of $0.44.

Cash and investments at quarter-end totaled $526.9 million. In Q2, NetScout generated $6.6 million in cash flow from operations and used $2.2 million for capital expenditures. The company also repurchased approximately 741,000 shares at a total cost of $16.6 million during the quarter.

Reflecting the strong performance to date, management raised its prior FY ’26 revenue and non-GAAP EPS guidance ranges. We note that the midpoints of the revised ranges sit above our prior estimates and consensus. For Q3, management expects revenue of $230.0-$240.0 million and non-GAAP EPS of $0.83-$0.88. Prior to revisions, we were projecting Q3 revenue and non-GAAP EPS of $229.2 million and $0.80, respectively, while consensus stood at $239.7 million and $0.86.

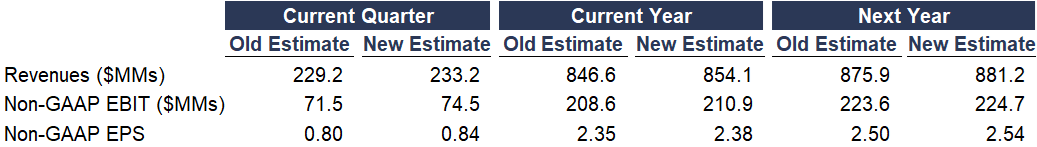

Exhibit II: Estimate Revisions

Source: K. Liu & Company LLC

We raise our estimates for FY ’26 and FY ’27, primarily reflecting an uptick in our product revenue and product gross margin assumptions. We also introduce our FY ’28 projections, which imply sustained revenue growth of approximately 3% and further expansion in the operating margin to 26.2%.

Our report with model and disclosures is available here.

Disclosure(s):

The analyst, a member of the analyst’s household, and/or an account in which the analyst exercises discretion hold(s) a long position in the common stock of NetScout Systems (NTCT).